GAO-20-366, Accessible Version, Tax Payer Compliance: More Income Reporting Needed for Taxpayers Working Through Online Platform

SCRIBNER, HALL & THOMPSON, LLP INSURANCE COMPANY INFORMATION REPORTING AND WITHHOLDING UPDATE June 30, 2008 Legislation Prop

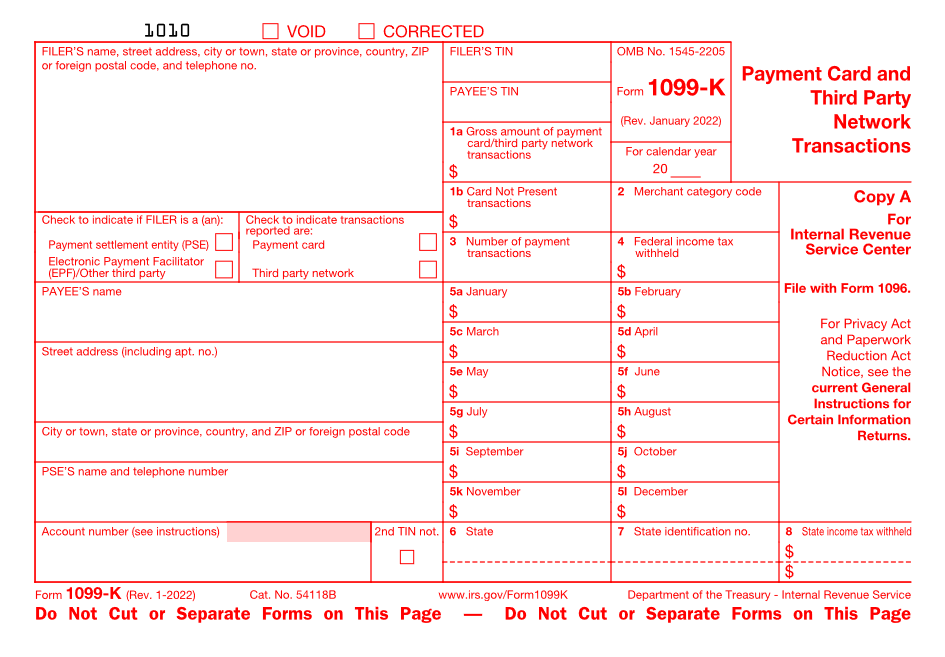

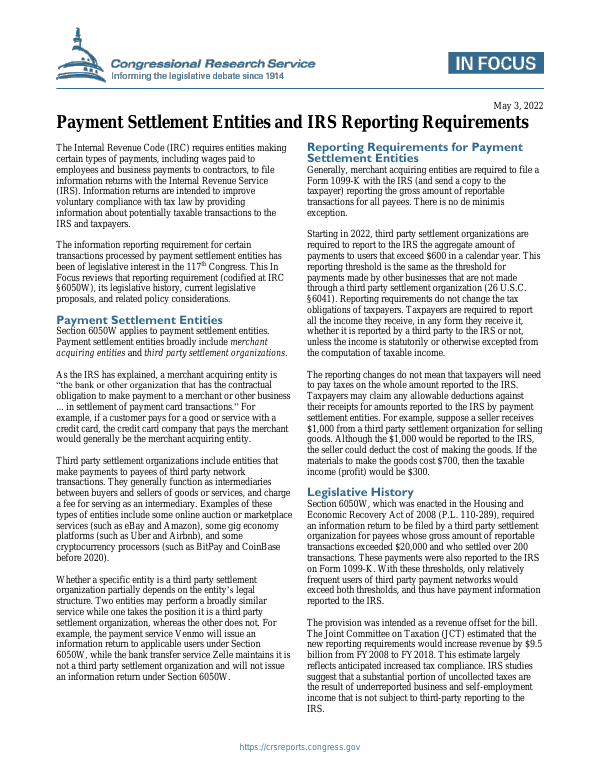

810-3-26-.03 Reporting Requirements of Payment Settlement Entities (PSE). (1) Payment settlement entities, third party settlem

Emerging Compliance Issues Subgroup Report A. IRC § 6050W and Form 1099-K, Payment Card and Third Party Network Transactions, R